Providing Services Since 1983

EI Digest FYI August 29, 2012 (Actual Sample) |

|

|

| Amount of Waste Shipped to Fuel Blenders | ||

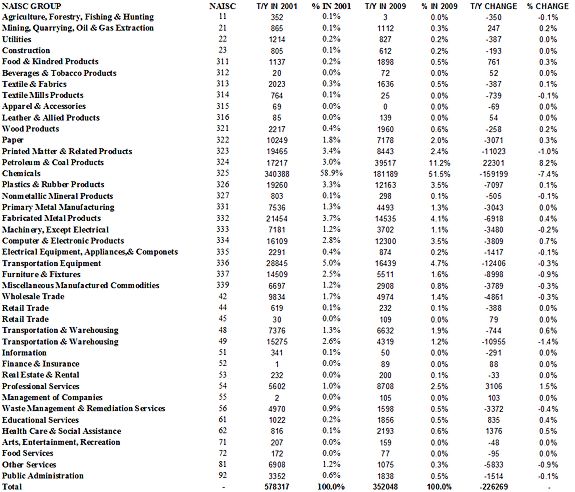

| We know from discussion that we have with our clients that the majority that purchase our hazardous waste shipping databases are using them for purposes of helping qualify customers for sales purposes. As was illustrated in some of previously EI Digest – FYI, the databases can also be used to evaluate trends as to the overall number of companies needing specific services by North American Industrial Classification Code (NAICS) establishments on a nationwide, regional or state wide basis. The database can also provide insight into the amount of hazardous waste collectively shipped by NAICS establishments in each biennial reporting year. Therefore, similar to what we have demonstrated with comparisons of the number of establishments in 2009 and 2001, it is possible to do comparisons as to the amount of waste shipped in different biennial years. Provided in Table 1 is the amount of hazardous waste collectively shipped by NAICS establishments in 2009 and 2001 on a nationwide basis to fuel blenders. Table 1 provides the data in numerical order of the NAICS code. | ||

| Table 1 - Amount of Waste Shipped in 2001 and 2009 to Fuel Blenders | ||

| ||

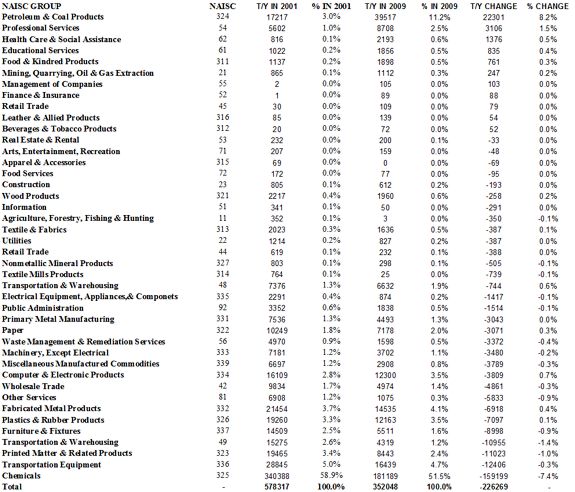

| The same information that is provided in Table 1 is provided in Table 2; the difference being Table 2 is sorted in order of the change in the amount of waste shipped. The data on the amount of waste collectively shipped by various NAICS establishments provides a different perspective of the grass roots changes taking place in the marketplace than provided by just the changes in the number of establishments. (For comparison purposes, we have appended the previous EI Digest FYI with numerical changes to the number of NAICS establishments shipping to this FYI.) | ||

| Table 2 - Amount of Waste Shipped in 2001 and 2009 to Fuel Blenders | ||

| ||

|

As is obvious from Table 2, the largest change taking place between 2001 and 2009 is the in the NAICS establishments classified in the three digits constituting chemicals (325) with a net decrease of almost 160 thousand tons. The biggest collective improvement came from NAICS establishments in petroleum and coal products (324). If one does a comparison between the changes in the number of the establishments (see Table 2 in appended FYI) and amount of waste shipped (see Table 2 in this FYI), it is obvious that numerical changes in the number of NAICS establishments are often not reliable indicators of the changes in the amount shipped. One obvious reason for this is that the amount produced from various type of NAICS establishment is different; for example, chemical plants usually generate more waste per establishment than retail establishments. However, another more subtle reason is that a small number of very large generators produce the majority of waste being reported shipped. A caveat that needs to be added to this particular analysis is that the change in the amount of waste shipped to fuel blenders can be result of numerous factors. One of those factors is that hazardous waste to be used as fuel could have been shipped directly to the commercial boiler and industrial furnace rather than an intermediary fuel blender. In addition, the reduced need for hazardous waste fuel in 2009 could have resulted in some shipments being diverted to other waste management alternatives. Anyone wishing to provide additional comments or information on this topic should send them to EI Digest@envirobiz.com with the subject line EI Digest – FYI: Amount of Waste Shipped to Fuels Blenders. Envirobiz reserves the right to select which comments get circulated and edit comments as it deems necessary before circulating them on EI Digest FYI. | ||

|

Conditions of Purchase: This report is only sold pursuant to a purchase agreement. The Envirobiz Group reserves the right to not enter into a purchase agreement with any potential purchaser. The purchase agreement requires the purchaser to agree that the document is confidential and agree to take precautions to keep the report's contents confidential. The agreement prohibits the disclosure of any portion of the report's content to any third party.

For further information on the EI Digest FY, please contact: customerservice@envirobiz.com or call 952-831-2473

About The Envirobiz Group: The Envirobiz Group Inc. provides market intelligence, market analysis, and strategic assessments regarding the options, challenges, and opportunities for resource conservation and environmental protection in North America. Our practice focuses on the management of resources contained in manufacturing processes residuals and post-consumer discards that can be conserved for beneficial use and/or require management as solid wastes to protect the environment.